State-owned enterprises threaten economic prospects – digest of the Belarusian economy

State-owned enterprises threaten economic prospects – digest of the Belarusian economy

On 24 January 2018, government officials announced new plans for support to Belarusian entrepreneurs in the current year. Meanwhile, according to Belstat, the state industrial sector remains the main driver of economic growth accompanied by a strong recovery of exports. However, the absence of an acceptable strategy for solving state-owned enterprises’ debt problems continues to threaten financial stability and long-term economic growth.

Entrepreneurship: several steps forward

In the second half of 2017, the authorities adopted a package of documents aimed at facilitating private business development. Legislative innovations greatly simplified the conduct of business, while radically reducing regulatory and administrative barriers. In addition, the government introduced additional tax and regulatory liberalisation for certain entrepreneurial activities; primarily small companies and individual entrepreneurs. Finally, the authorities expanded the possibilities for self-employed individuals (without registration of small businesses), for example, in the fields of craft activities and agritourism.

Next, on 24 January 2018, government officials announced plans to support entrepreneurship in the current year, including increased lending, lowered loan rates and several changes to taxation. In particular, the head of the National Bank of Belarus’s department for monetary policy and economic analysis, Dmitry Murin, says that lending will grow by 9-12 per cent, which supposedly will not harm macroeconomic stability.

Moreover, the National Bank expects a small drop in lending rates by approximately 1 percentage point. According to Murin, inflation expectations deter a more radical decrease in rates. Namely, the results of the analytical survey of individuals show that they subjectively feel inflation at 13 per cent, while prices in 2017 increased by two times less.

Finally, according to the deputy minister for taxes and duties, Ella Selitsky, the government will prepare proposals for comprehensive reforms of tax legislation throughout the year. It is likely that the fiscal system will undergo significant changes in 2019, with stabilising tax legislation the main goal for the next three years.

These measures will support private sector development. However, the key barrier to entrepreneurship remains unequal conditions for economic activity in comparison with state-owned enterprises (SOEs) rather than the regulatory environment.

In this respect, the artificial “bias” in allocating resources in favour of the state sector remains especially important. Without its elimination, the private sector will be stuck in the doldrums and unable to fully realize its potential.

Real sector: rising debts

While measures to develop the private sector have only limited effects, the state industrial sector remains the main driver of economic growth. In 2017, it showed growth of 6.1 per cent year-on-year.

According to honorary chairman of the board of the Business Union of Entrepreneurs and Employers, Georgiy Badey, this growth mostly occurred due to the favourable macroeconomic environment in key trade markets. However, the real sector lacks new drivers of growth and encouraging changes in economic policy.

In particular, financial instability associated with low quality SOE debts remains a serious threat to the economy. Moreover, Belarusian SOE debts continue to rise. For the first nine months of the previous year, the payments on loans and borrowings exceeded the volume of gross value added in the industrial sector as a whole. Therefore, in the past year, they not only failed to cover their old debts but became further indebted. As a result, the total national debt currently hovers in the range of 45-50% of GDP.

Measures recommended by the IMF to kickstart the process of resolving debt problems include strengthening creditors’ rights, permitting bankruptcy procedures for large debtors, and the sale of SOE debts at a fair market value (compared to their nominal value).

At the same time, this tough solution may seriously disturb the real sector (the sector of the economy that actually produces goods and services) and has both social and political implications. The “soft” alternative assumes new subsidies from the state.

However, such an “easy” solution only freezes the problem and limits its negative impact on the current macro dynamics. In the future, the debt problem may reveal itself at any moment and cause a new wave of economic recession.

Foreign trade: imbalances grow

Stable global growth contributes to revived demand for Belarusian commodities and industrial goods exports to Russia. This recovery in exports gave a positive impulse to the Belarusian economy, although growth remains fragile. For example, in the second half of 2017, the physical volume of shipments of “growth leaders” in the first half of the year (oil products, potash fertilizers, tractors and trucks) dropped. In contrast, the delivery of goods that previously lagged behind (food products, tires, refrigerators and shoes) increased.

Instability in export growth therefore remains a challenge for the whole economy, since the prospects for output growth highly depend on export performance.

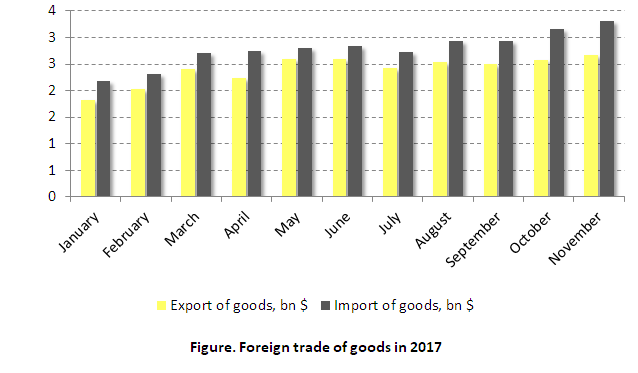

Overall, foreign trade turnover of goods during the eleven months of the previous year reached $54.1bn and increased by 23.5 per cent year-on-year (see graph below). In November, imports of goods exceeded exports by $600m increasing the negative balance in merchandise trade to $4bn year-on-year, which surpassed 2016 figures by more than $800m.

As a result, the traditional imbalances in the Belarusian economy return: the growth of export goods invariably leads to the import growth and a deterioration in the balance of payments. Thus, while the results of measures for the development of the private sector remain invisible, positive dynamics of the economy will sustain only in case of a new round of export growth. Furthermore, the absence of an adequate strategy for solving the debt problem of SOEs continues to threaten financial stability.

This article is part of a joint project between Belarus Digest and BEROC.