Privatisation: One Step Forward, Two Steps Back – Digest Of The Belarus Economy

Privatisation: One Step Forward, Two Steps Back – Digest Of The Belarus Economy

On 4 May 2017 Belarusian president Alexander Lukashenka declared that Belarus plans to gain approximately $50bn in exports off goods produced in the Great Stone industrial park.

Meanwhile, on 3 April 2017, Moscow and Minsk resolved all their disputes in the oil and gas sector.

On 18 April 2017, Belarusian prime minister Andrey Kobyakov announced that the Belarusian economy has avoided recession, with 0.3 per cent GDP growth in the first quarter of the year.

Privatisation: standby mode

On 21 April 2017, the authorities once again announced that state-owned enterprises (SOEs) would not be privatised in the near future.

However, for the IMF, privatisation of major SOEs is a key condition if Belarus wants to receive a new credit line (worth approximately $3bn). More precisely, the IMF wants Belarus to prepare approximately 10 SOEs for pre-sale. The government has so far failed to begin any stage of this process.

Although the official list of state enterprises up for sale in 2017 includes 38 joint-stock companies, almost nothing has been transferred into private hands – neither auctions nor tenders of sale for the SOEs have been declared so far. The Belarusian government insists that this is due to lack of interest from potential investors.

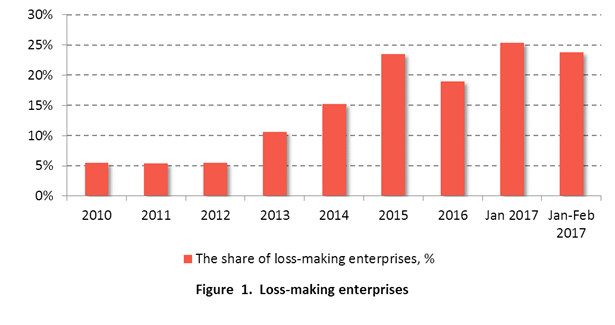

This is unsurprising, as many SOEs are in a difficult financial position due to high credit indebtedness (see Figure 1). According to the National Bank of Belarus, at the beginning of 2017 the debt load of the real sector exceeded its monthly revenue by 3.2 times. These SOEs, suffering from chronic debt and a failed business model, have proved impossible to sell as whole business entities.

As a result, on 21 April 2017, Lukashenka stated that privatisation is unrealistic, essentially ending discussion about the fate of the largest SOEs.

Instead, the Belarusian authorities want to attract foreign investment. Each regional governor has been ordered by the president to bring in no less than $100m in investment each year. However, the Belarusian economy remains unattractive to foreign investors, which is reflected in the reduction of foreign direct investment in 2015 and 2016.

The oil and gas dispute: finally resolved

On 3 April 2017, Belarus and Russia resolved their longstanding oil and gas dispute and signed the corresponding documents on 13 April 2017.

As a result, Russia agreed to increase oil supplies to Belarus to up to 24m tonnes and sell gas to Belarus at a discount. Over the next year, the price of Russian gas for Belarus will fall to $129; in 2019 the price will decrease even more. Nevertheless, experts are dubious that the pursuit of a unified gas market by 2025 will encourage Russia to supply Belarus with gas at domestic prices.

According to the Scientific Director of the IPM Research Center, Irina Tochitskaya, if Belarus paid Russian gas prices, all other countries in the Eurasian Economic Union would insist on similar discounts. This would be a significant loss of income for Russia.

In turn, the Deputy Chairman of the Belarusian Scientific and Industrial Association, Georgy Grits, admitted that according to the agreement, independent gas operators would be able to sell gas to Belarus, not just Gazprom. However, if this were the case, the stock market would determine the price of gas, precluding preferential conditions for Belarus.

What's more, he also noted that the gas transportation system in Belarus belongs to Gazprom. Therefore, it would be difficult to deliver gas from independent operators without agreements with Russian authorities.

Thus, the dependence of Belarus on Russian gas supplies will only increase, guaranteeing new tensions in the oil-gas sector in the near future.

Economic growth: first time in 24 months

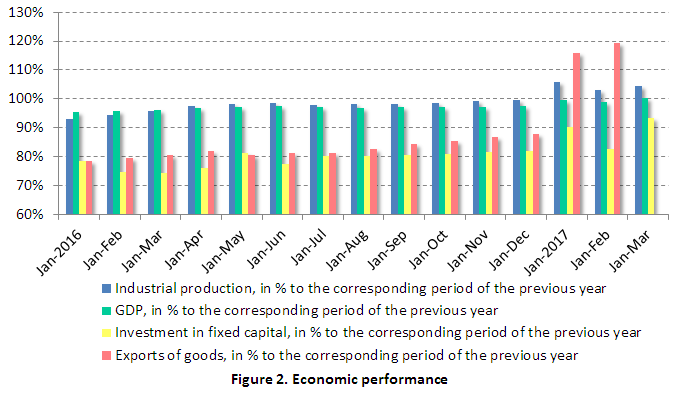

For the first time in two years, the Belarusian GDP has grown. According to the National Statistical Committee of Belarus, in January-March 2017 GDP growth reached 0.3 per cent year on year (see Figure 2).

On 18 April 2017, Belarusian Prime Minister Andrey Kobyakov stated that the economy was gradually recovering from an economic downturn and is on track for its forecasted targets, which include 1.7 per cent GDP growth. However, the authorities' optimistic forecasts are largely dependent on growth of oil refining and export of petroleum products.

Meanwhile, the IMF and the World Bank still predict that the recession in Belarus will continue. The Russian bank Sberbank has stated that given sluggish economic growth, the recession in Belarus will end only in 2018.

The considerable volume of foreign debt payments for the current year, the prolonged reduction in real household income, the limited effectiveness of monetary policy (due to high level of dollarisation in the economy), and the lack of significant resources for the state budget to finance its investment programmes all constrain possibilities for further growth.

Independent experts maintain a similar position, adding that the Belarusian GDP needs to improve by 7 per cent just to return to its 2014 level (in Belarusian constant prices).

According to the head of the analytical centre Strategy, Leonid Zaiko, if we compare dollar equivalents, the GDP must grow by nearly 40 per cent (from $47bn up to $76bn). Thus, he concludes that even with a 4 per cent growth per year, the economy will need more than ten years to return to its 2014 level.

All in all, it seems that the past two years of recession have not shaken the official economic policy of the last two decades. The authorities still rely on the public sector and oil revenues. Meanwhile, the lack of progress in privatisation limits Belarus's investment appeal and hinders further prospects for sustainable long-term growth.

Aleh Mazol, Belarusian Economic Research and Outreach Center (BEROC)

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)